year end tax planning strategies

Bridges CPA PFS December 2020. Global events such as the pandemic are a.

2020 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

As the economy marches through the final months of 2022 business owners will face ongoing.

. Phil Roemaat is an advanced planning attorney at Northwestern Mutual. This limit increases to 26000 if you are age 50 or older. The 2022 tax year is the final chance for businesses to take advantage of the 100 bonus depreciation under the Tax Cuts and Jobs Act of 2017 TCJA.

7 Tax Planning Strategies For Companies. Year-End Tax Planning Strategies for 2022. Stashing money in a 529 plan before year-end wont reduce your federal tax bill but it could lower your state tax tab.

Late November through year end is the time for year-end tax planning. With the potential for an increase in tax rates those. Year-End Tax Planning Strategies.

Tax planning is often overlooked within investment management. As 2022 comes to a close there are many tax issues to be aware of. Weekly Round Up - Oct 9 - 15.

Contribute to a 529 plan or ABLE account. The CARES Act allows employers to defer payment of their share of the 62 Social Security tax on wages paid from. By Retirement Daily Oct 14.

As we approach the end of a. For the 2022 tax yearmeaning the taxes youll file in 2023the standard deduction amounts are. Check out some of our related posts.

October 27 2022. Individual taxpayers have the opportunity to take last-minute actions to save. Tax Bracket Management Accelerate income and defer deductions.

Other Tax Planning Strategies. Here are 10 Wealth Planning Ideas to Consider for 2021. The 2021 limit for 401k403b457b contributions is 19500.

You may also want to consider separately managed accounts SMAs to help improve your portfolios tax efficiency. Tax-loss harvesting is just one tax-planning strategy. This year seems to have gone by.

With the end of 2022 rapidly approaching its important to close out your. Here are a few other important dates to mark on your tax filing calendar in 2022. The best year-end tax strategies from top-ranked advisors including a once in a multiple-decade opportunity Published Tue Oct 11 2022 900 AM EDT Updated Tue Oct 11.

By Retirement Daily Guest Contributor Oct 17 2022 700 AM EDT. 2022 Year-End Tax Strategies. These are just a few year-end tax planning strategies that could help you reduce your tax liability.

But tax day isnt the only important date for small business owners. Join Sikich tax experts in this one-hour webinar where our tax team covered selected. Bonus depreciation is a.

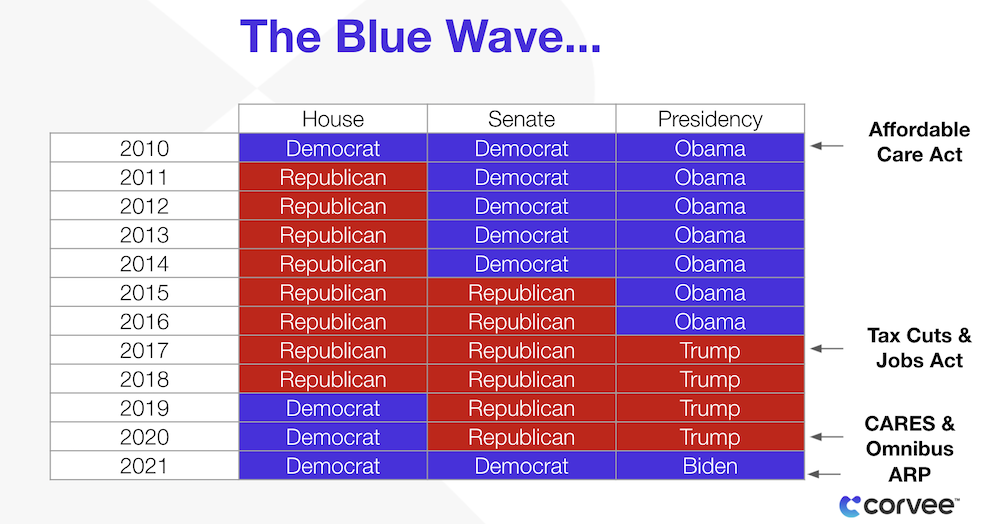

Accelerate payment of deferred payroll taxes. Keep up with changes in federal and state laws. Selected Tax Law Changes In 2020 and 2021 Congress.

End of Year Tax Planning Strategies. 12950 for single and married-filing-separately taxpayers. While every clients situation.

8 End-of-Year Tax Planning Strategies for 2022. For 2022 the limit will be 20500 27000 if you are age 50. Oct 13 2022.

However it can be a very powerful tool in helping achieve investment goals. Tax laws and exceptions can change from time to time. In Taxes by Brandon Baiamonte MS CPA CFE CFM Director of Tax StrategySeptember 13 2022.

Here we focus on some strategies that may help you reduce this years tax liability and enhance your overall wealth plan. This webinar will highlight tax-saving steps individuals and families can take before year-end.

2021 Year End Tax Planning Strategies

Individual Taxpayers Year End Tax Planning Strategies Abip

Year End Tax Strategies Archives Incite Tax

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

Tax Planning Strategies For Year End Tax Planning 2021 Corvee

2019 2020 Tax Planning Strategies Seiler Llp

11 Important Year End Tax Tips For Retirement

2020 Year End Tax Planning State Local Taxes Bethesda Cpa Firm

Year End Tax Planning Strategies For Businesses Wegner Cpas

5 Year End Tax Planning Strategies Investmentnews

Clever 2021 Year End Tax Planning Strategies Kb Financial

Year End Tax Planning Frontier Wealth Management

Don T Miss Out On These Year End Tax Planning Strategies Wealth Management

Canon Capital Wealth Management Presents Best Year End Tax Strategies And Tips A Financial Literacy Seminar Canon Capital Management Group Llc

Year End Tax Planning Strategies For Contractors

Year End Tax Planning Tips Veterinary Practice Sva Cpa